The global real estate market is very attractive for foreign investors.

As an international agent, no doubt that many of your foreign buyers have their eye on Switzerland, North America, France, Spain and Portugal.

Due to COVID-19, the economy is in recession but that is the time that your investors are especially keen to scan the markets to find investments with great returns!

France: A Resilient Market

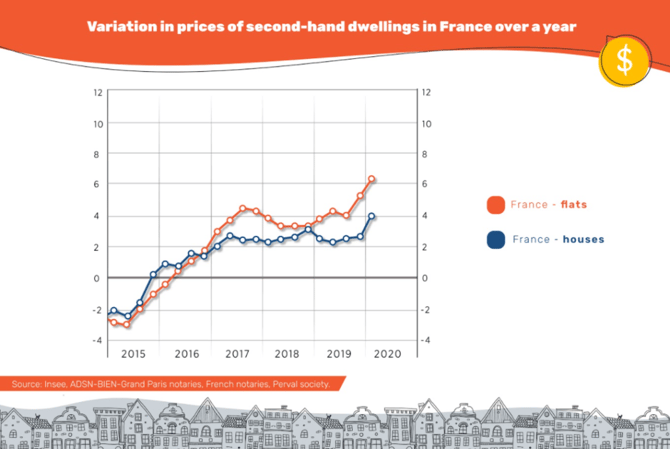

The French Real Estate Market continues to be resilient. During the first quarter of 2020, house prices in France rose by 5%. However, there has been a notable increase for apartments – something to remind your foreign investors about.

Foreigners are buying French real estate for retirement, as an investment or for a holiday base or second home in France. Investing in the French real estate market is also a great opportunity for expatriates, especially with regard to rental properties.

Your foreign investor will not have any problem renting their Parisian apartment, as currently, demand is far greater than supply.

Switzerland: A Top Choice for Foreign Investors

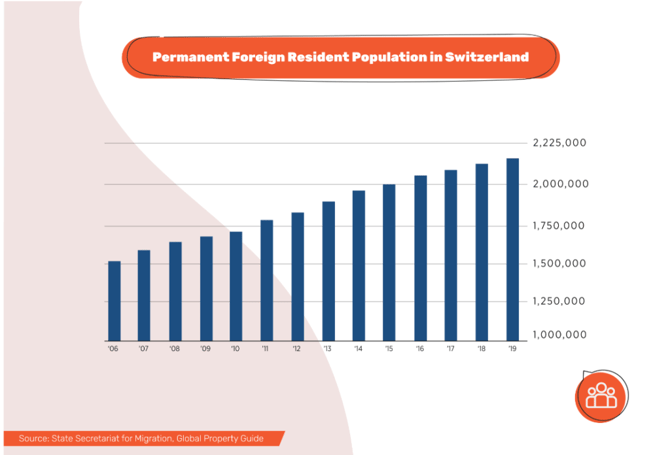

According to the State Secretariat for Migration (SEM), Switzerland has one of the world's largest number of permanent immigrants per capita (about 25% of the population in 2019).

Keep in mind that there are a few restrictions for foreign investors. There is an annual quota of permits set by the Federal Government for non-resident foreigners seeking to acquire property in Switzerland.

The buy-to-let market remains a dream to foreigners. A foreigner can only acquire a rental unit if he constructs subsidized housing. This means that foreign investors can only buy new rental housing if there is a shortage of rental offerings in the location of the unit. Foreign investors can build houses to rent, but the rental prices must be lower than other offers in the local market.

In the first quarter of 2020, the prime rental income was between 1.5% and 2.1% to 1.7% and 2.3% in the same period in 2019. The rates have held steady during the pandemic and can be expected to increase as the economy recovers.

The American Dream

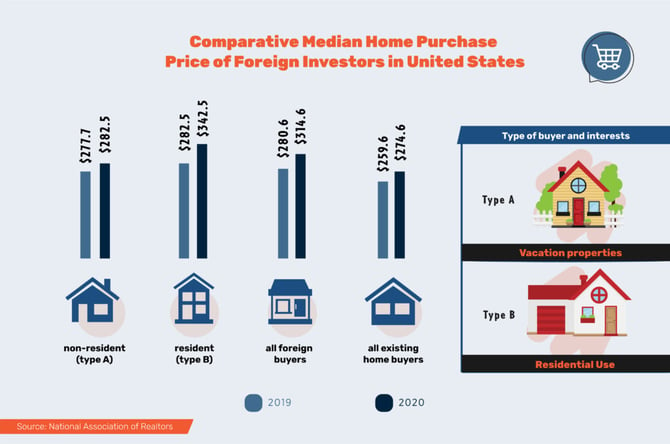

From April 2019 to March 2020, foreign buyers invested $74 billion into existing U.S. home sales, a small decrease from the previous 12-month period. The average price of homes purchased by foreign buyers was $314,600: higher than the average home price of $274,600 for homes sold in the U.S.

This price variation shows the choice of location and the type of properties desired by foreign buyers.

The average purchase price among foreign buyers residing in the USA (Type B) was higher than that of those who are living abroad (Type A).

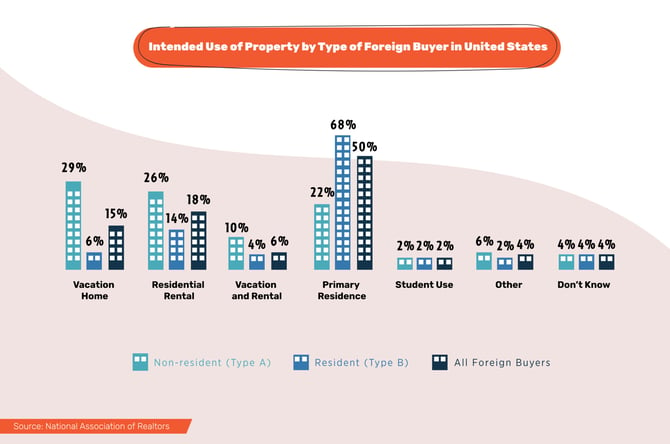

The American market is attractive to international clients either for residential use, investment, or vacation purposes. However, 50% of foreign buyers purchased properties to use as their primary address. Of foreign buyers who lived abroad, 65% bought a North American property as a vacation home, to rent, or for both purposes.

In general, foreign buyers tend to purchase detached single-family homes and townhouses. However, those who live abroad tend to prefer to invest in condominiums.

Portugal: Paradise for Foreign Investors

For several years now, Portuguese real estate has been favored by foreign buyers. In 2019, 8.5% of Portuguese properties were sold to non-residents, representing 13.3% of the total amount sold.

When compared to other European countries, Portugal has one of the lowest real estate price points, offering a higher return on investment. There are many ways to enjoy properties in Portugal:

- Primary resident: many foreigners chose Portugal to live, to retire, or to have a second home. The ‘Golden Visa’ is one benefit to foreign investors, leading to 1,630 residential properties sold in Lisbon’s Urban Rehabilitation Area (about 744,3 million euros).

- Local Accommodation: low costs, safety, historical heritage, dining options, and diversified lifestyle options (beach, countryside, and city) are attractive factors for foreigners. The tourism boom in recent years contributed 8.7% to national GDP.

- Rental: this might be one of the best opportunities for foreign buyers. Currently, the rental market experiences more demand than supply.

Today, more than 580,000 immigrants are living legally in Portugal. There are more than 60,000 International students there (in the first quarter of 2020) and more than 155,000 foreign workers who are looking for a place to live in the country. Portuguese people find themselves without rental options, leading them to escape from urban centers to the peripheral municipalities because of the rise of the rental rates. Additionally, Portuguese landlords are converting their properties into local accommodation units.

Spain: A Market Worth Watching

Foreigners can buy and resell all kinds of properties: residential, commercial or land. In 2019, Spain had 102,252 foreigners investing in its Real Estate Market – 77% more when compared to 2007.

Spain is a strong world leader in the tourism market. The surge in house sales in recent years was driven mainly by foreign investors buying houses on the coast and in cities like Barcelona and Costa del Sol.

Real estate costs are lower in cities like Barcelona and Madrid when compared to cities like Paris, London, Rome or Amsterdam – an attractive factor for foreign investors. Spain has high levels of education, attracting many international students, especially in business schools, which are among the most important in the world explains Ignacio Martínez-Avial, according to managing director of BNP Paribas.

In the first quarter for 2020, rental prices were about €10.2 per sq. m., an average of €1,098 per month. However, according to Brainsre, in six municipalities, prices exceeded this figure: Barcelona, Madrid, Bilbao, Badalona, Hospitalet de Llobregat and Palma.

Foreign Buyers are Acting Now

There are exciting opportunities for foreign buyers at this time. Your listings will be viewed by buyers across the globe, through ListGLobally’s international network of real estate portals – making you front and center in the foreign real estate market. Renewed properties are relatively cheaper than new ones and offer financial opportunities. Be sure to share your expertise with your clients - many properties move fast due to high demand and little supply!

More About ListGLobally

ListGlobally is the largest network of real estate portals in the world. We publish listings from 100,000 agents worldwide and distribute them on 100 real estate portals in more than 60 countries.

Our company is based in Switzerland and since 2012, we have been helping real estate professionals around the world to connect with international buyers. ListGlobally ensures that their listings are visible in the country of origin of potential buyers and translated into 25 different languages.