The effects of recent global economic, political and climactic events have caused significant changes to consumer buying & selling trends in real estate. This report provides a summary of 2022 leads activity in the United States based on information from our Lead Source data, results from ListGlobally’s agent survey findings and validation by cross-referencing trusted sources.

US real estate market in 2022

The housing market downturn in the last half of 2022 was due in part, to an increase in mortgage interest rates. Last year, the Federal Reserve had increased rates aggressively in an effort to curb inflation, and as a result, the real estate market in the US suffered. By the end of the calendar year, these rising mortgage rates resulted in less interest from home buyers and ultimately, more pressure on sellers to lower their prices. The housing market began slowing down over the last few months of 2022, with fewer people applying for mortgages and a higher percentage of people backing out of purchase contracts. Mortgage rates are now significantly higher than they were at the beginning of 2022 and home prices were more than 6% higher than the previous year, which was challenging buyers to find affordable housing options. 1

The overall housing supply in the United States remains limited, with homeowners who recently purchased homes at low mortgage rates choosing to stay put. This contributes to tight inventory and high prices that may be unaffordable for some, and particularly for first-time homebuyers. While home prices remain high compared to 2021, they are not as high as they were earlier in the 2022 calendar year.

QUICK STATS:

-

The median price of existing homes in the US was $413,800 in June 2022 – a record high 2

-

Median prices fell to $379,100 in October 2022, which still represents a 6.6% increase from the previous year 2

-

Mortgage applications were at some of their lowest levels in 25 years in Q3, 2022 3

High inflation means that people are spending more money to buy basics like gas and food, which results in less disposable income available to them. Because household budgets are affected in this way, some home buyers will be nervous about taking on new or bigger mortgages and may delay the purchase of a home. Because interest rates are the primary tool used to control inflation, homebuyers will qualify for smaller mortgages than they had before and will also have higher mortgage payments. This suggests that many potential home buyers are currently struggling to afford the high costs of housing.

There are signs that the housing market is experiencing a correction after several years of strong growth, but the process has been slow. The direction of US home prices in 2023 will likely be influenced by the movement of mortgage rates.

Foreign Buyers

During the pandemic, foreign buyers receded from the real estate market, leading to increased competition for buyers who were still active in the US market. This decrease was due to travel restrictions and other inconveniences caused by the pandemic, which made it difficult for international buyers, especially those seeking a vacation home, to visit properties in person. However, we saw that foreign real estate investments started to increase again in 2022. 2

Agent Insight: the recent decline in mortgage rates may indicate that the housing market is close to reaching the bottom of the current cycle.

Foreign buyers are more likely than domestic buyers to pay for homes in cash, with 44% paying all-cash in the past year compared to 24% of all other home buyers in the US. They are also more likely to purchase a property as a second home, with 44% using it as a vacation home, rental, or both, compared to 17% among all existing-home buyers. 4

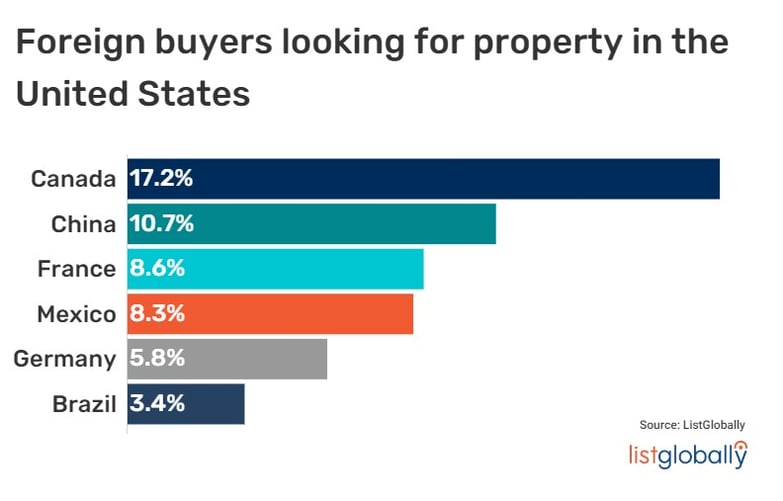

Top foreign buyers in the United States

In 2022, Canadian buyers were the largest group of foreign buyers of property in the United States. However, Chinese buyers held the highest value of residential properties with sales totalling $6.1 billion. 2

Despite the supply shortages and rising mortgage rates that have pushed up home prices, the share of international buyers in the real estate market is expected to continue to increase. This is due in part to:

-

A strong US dollar, which is appealing to foreign investors who are able to pay with USD cash and are not subject to changes in interest rates. This affords them a greater degree of purchasing power abroad.

-

US properties are still a relative deal for many international buyers, with typical property prices being higher in other cities such as Hong Kong, London, and Toronto compared to San Francisco and Miami. 4

-

Travel restrictions had lifted in 2022. International buyers prefer to see a property in person – especially those who are looking for a vacation home.

-

The opportunity to purchase properties from sellers that are distressed from the pressures of the increased overall costs in the country.

Compared to our 2021 US International Buyer Report, the largest group of foreign buyers for US property remain consistently from Canada and China. Also, we see a slight drop in German buying activity this year, and a slight increase in French foreign interest. Overall, the top countries of interest held steady from year to year.

Top regions of interest

From our lead source data, the top five regions of interest to international buyers looking for property in the US are:

-

29.2% Florida

-

19.8% California

-

11.8% New York

-

4.5% Texas

-

3.9% Hawaii

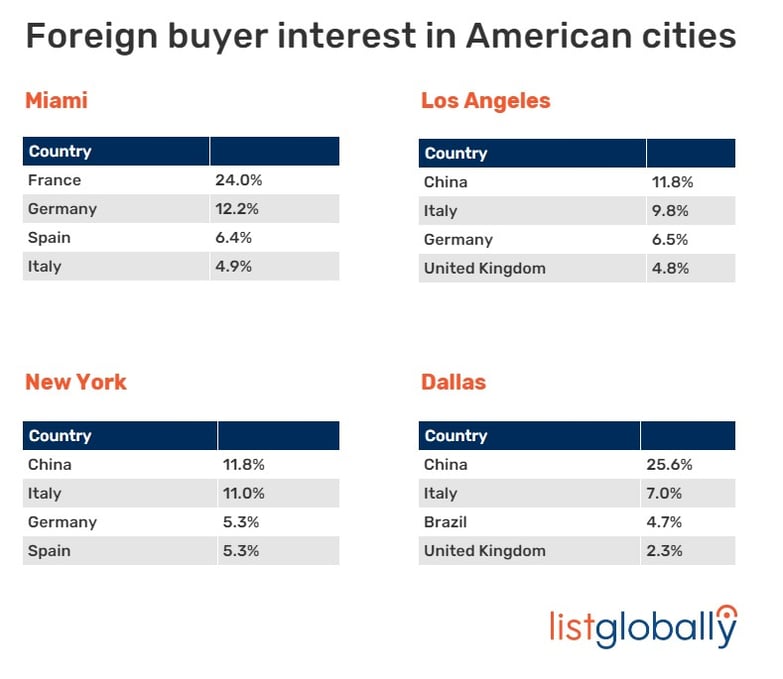

Foreign buyer interest in these cities, by country of origin, is shown below:

Type of property searches

Overall, 57.7% of our leads searched for US homes for sale, while 42.5% searched for rental properties in 2022. These numbers are quite different when compared to 2021 search habits, with 83.7% searching for property for sale and 16.3% looking for rental properties last year.

The majority of leads in 2022, were for homes for sale – at 61.2%, with 28% of leads inquiring for apartments for sale in the United States.

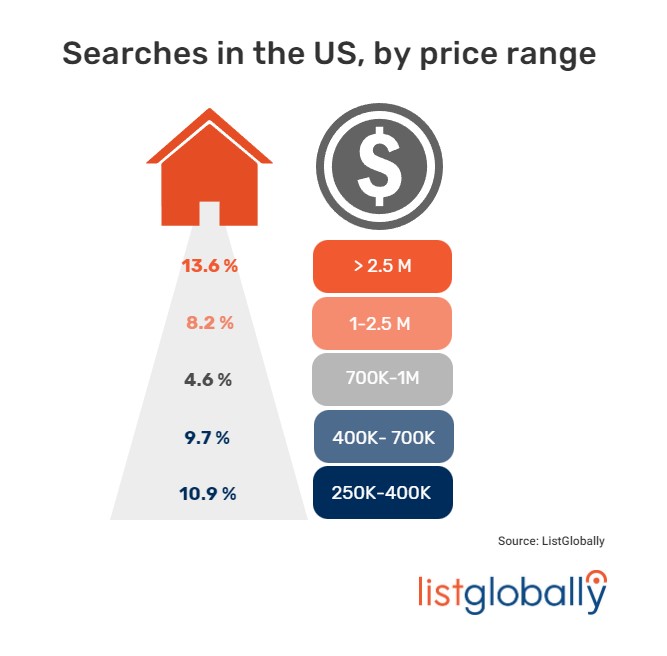

Here is a distribution of searches by price range, for property for sale in the United States in 2022:

This data excludes commercial or land for sale, and rental property searches, and is an indicator of the occurrence of residential properties on the market in specific price ranges. In 2022, homes for sale in the >2.5M price range was 4.5 points higher than it was last year.

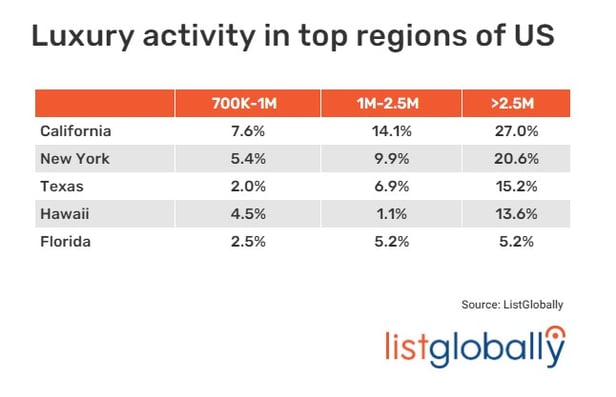

Luxury buyers in the United States

The luxury real estate market is not experiencing critical signs of distress, despite a decline in the number of transactions over the past few months. Low inventory levels are preventing buyers from making low offers, and home valuations remain fairly stable. Homes were mostly purchased during the pandemic with long-term ownership in mind, and although priorities may have shifted, the ownership mindset has not. The affluent are willing to look beyond short-term turbulence and focus on future opportunities. Prices have fallen modestly over the past 6 months but still remain at near record levels across North America.

The current US luxury real estate market is characterized by a decline in sales volume, inventory levels, and new listings. There is also a significant gap between the median list price of properties still on the market and the median ‘sold’ price for recent sales in both single-family and attached property markets. This disconnect between seller and buyer expectations is hindering sales for homes that have been on the market for a long time without a price reduction, but there is little downward pressure on correctly priced homes, as they are selling within the average days on market of 20 rather than the 50-60 days typically seen before the pandemic.

Agent Insight: It is unlikely that there will be a significant decline in luxury home prices unless there is a drastic change in the economy or a significant increase in new inventory.

The return of more moderate conditions in the luxury real estate market in 2022 was not unexpected, but the speed at which the change occurred due to a weakening economy, was significant. Buyers and sellers need to adjust their expectations in this cooling market, as the fast investment returns and unfettered buying and selling of luxury homes has cooled.

QUICK STATS:

Here are some interested statistics on single-family luxury homes North America:

-

Seller's market with a 21.89% sales ratio

-

Homes are selling for an average of 97.95% of list price

-

The median luxury home sales price is $1,280,000

-

Markets with the highest median sales price are: Vail ($7,800,000), Whistler ($5,825,000), Telluride ($4,250,000), and Los Angeles Beach Cities ($3,800,000)

-

Markets with the highest sales ratio: Cleveland Suburbs (88%), East Bay (74%), St. Louis (55%), and Howard County (51%) 5

The cost of borrowing money is likely to remain high for some time, so homes will need to be purchased with a long-term view in mind. Despite this, demand for luxury properties has increased significantly over the last few years, driven by a growing affluent demographic that considers owning a luxury property a necessary part of their asset portfolio. This trend is likely to continue, although demand is expected to return to a more sustainable level.

Market watch

The US housing market has been experiencing a slowdown, with home sales declining for nine consecutive months, lower inventory levels and mortgage applications at their lowest level in 25 years. However, experts are divided on whether the market will experience a crash or simply "correct" itself, with some predicting a 5% drop in prices and others pointing to the strong homeowner equity and more stable mortgage market, as indicators of a milder correction. Some markets may even see prices continue to increase, while others may see a decline. This currently makes it challenging for agents and their clients to navigate the market in their goal toward a home purchase and sale. The likelihood of a housing market crash, (defined as a 20 to 30% drop in prices and a decline in home sales) is considered low. 1

Real estate agents know that individual buyers' motivation and circumstances are strong influences on the decision of whether to buy now or wait. Sellers may decide to stay in their current homes rather than sell and face high interest rates or escalating rents of a rental property. Conversely, waiting may not be a viable option for some clients, and there is not likely to be significant improvement in prices or interest rates in the near future. Housing experts are keeping a close watch on the economy, which is being impacted by high inflation, high interest rates, and geopolitical uncertainties.

More about ListGlobally

ListGlobally operates the largest global network of property portals in the world, advertising across +100 property portals in over 60 countries, reaching a monthly consumer audience of over +150 Million potential buyers.

Do you have questions or need more information? We invite you to schedule some time with a team member who is glad to answer your questions.

Sources:

1 Forbes Advisor

2 National Association of Realtors

3 Mortgage Bankers Association, MBA

4 CNN Business

5 LMR North America