Welcome to 2019!

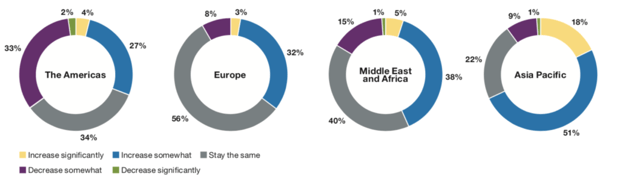

Now the new year has arrived it is time to prepare 2019 and to know what will be the trends during this year. The first tip we are now sharing refers to the ULI / PWC Annual reports. According to this report, in Europe, the secure long-term income is driving current European real estate investment. This happens while the industry hedges against potential interest rate rises, and we face an uncertain geopolitical backdrop.

The increase of the interest rate won't be a risk during 2019, although real estate professionals should be aware that it might change if there is a geopolitical shock to the monetary system. You should also might keep an eye on the relationship between the demand and available assets. Money will continue to arrive, and there is a strong belief that during 2019, the Asian investment will increase.

Cross-border capital into European real estate in 2019 Source: PWC Global Trends 2019

Cross-border capital into European real estate in 2019 Source: PWC Global Trends 2019

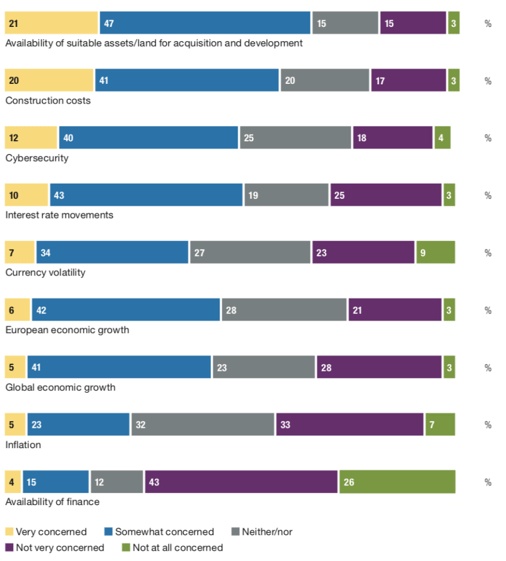

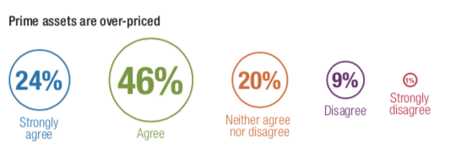

However this is causing some pressure on the core end of the market with 70% of PWC survey respondents either agreeing or strongly agreeing that prime assets are over-priced, especially if we consider cases like Spain or Portugal. To provide you a better overview, we invite you to have a look on the main subjects that will impact real estate market in Europe during 2019.

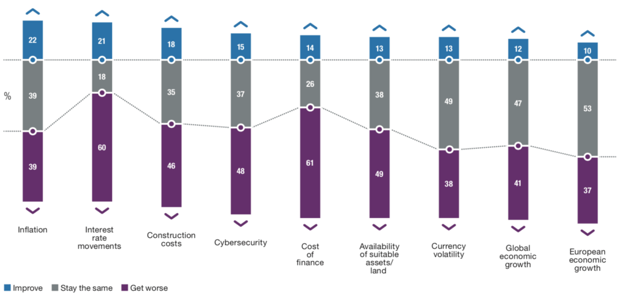

Subjects that will impact real estate business in 2019 Source: PWC Global Trends 2019

Subjects that will impact real estate business in 2019 Source: PWC Global Trends 2019

In the U.S., the situation is different. After years of steady growth and low interest rates, there will be an economic slowdown during 2019. Although many real estate and financial gurus expect a correction, and new opportunities may arise due to technology, demographic changes, and the continued winding-down of traditional retail.

Last but not least, all around the globe, new markets and actors will be coming into the catwalk during 2019. Now, let's find out what will be the main trends in the real estate market in Europe during 2019.

Finding quality assets

With the growing interest of international investors in Europe, real estate professionals are now displaying more concerns about property availability and pricing.

Even though almost 50% of the interviewees on PWC Report, expect the availability of assets to decrease and get worse in the next 5 years, the relationship between availability and pricing are tempered by the belief that the industry is in a good position and the financial background is generally positive.

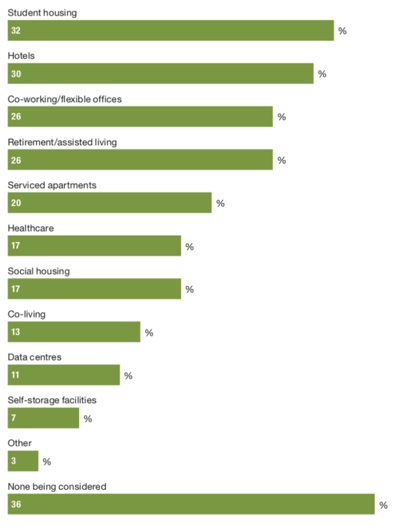

Diversify your properties

Real estate professionals have to keep an eye on new opportunities that are also arising. Some investors are now moving into alternative or niche areas, like student housing, retirement living, etc. This is a big market that is starting shy but will continue to grow.

Niche sectors being considered in 2019 Source: PWC Global Trends

Niche sectors being considered in 2019 Source: PWC Global Trends

Whatever real estate professionals do right now should be flexible enough to cope with a 10 years period. To do that, it is vital to be aware of some trends that revolve around the growing of the population, it's ageing, housing shortage, structural oversupply in retail property, a younger generation that is completely digitally enabled. We will have to be much quicker in evolving our product. The future will be much more about mixed-use communities.

When it comes to space changes, we have to keep an eye on another trend. The "moto" work, play, is giving rise to a reinvention of lobby space and common areas. Let's not forget about co-working spaces that are on the rise. Even though the residential sector will be in the spotlight, logistics and niche sectors such flexible offices and co-working spaces, are becoming more sexy.

Construction costs

Before the economic crisis, there were more companies ready to build properties. Nowadays the demand for new properties is higher than the offer, and building costs are also on the rise.

If before the higher construction costs were naturally compensated by a yield compression (with a higher sales pricing), this might not be the case anymore. So watch out!

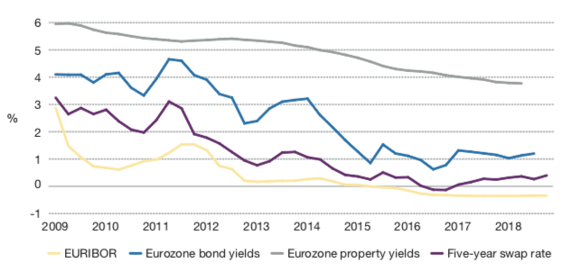

Interest rates impact

Now that the European Bank officially announced that the interest rates will remain very low, close to 0%, and that the bond-buying programme will end, we have a better picture for 2019 real estate development.

Eurozone property yields and interest rates evolution Source: PWC Global Trends 2019

Eurozone property yields and interest rates evolution Source: PWC Global Trends 2019

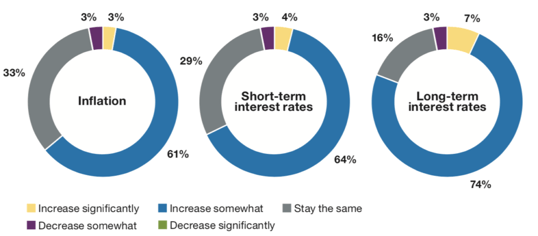

Surprisingly or not, this announcement has no major direct impact in the real estate business. Professionals think that even though the rates will remain pretty much the same, for the time being, the rental price and inflation will increase.

On the other hand, a geopolitical change can quickly increase the rates and this is why interviewees expect short and long term interest rates to increase a bit.

Interest rates and inflation in 2019 Source: PWC Global Trends 2019

Interest rates and inflation in 2019 Source: PWC Global Trends 2019

When it comes to the end of the bonds-buying programme we have to be careful that in markets like Spain or Portugal, this might be risky. Since 2008, they have not gone to the capital markets to fund themselves. If they are now going back to capital markets and cannot sell bonds at interest rates of less than 5 or 6%, they cannot fund themselves.

Geopolitical Risks and the Brexit

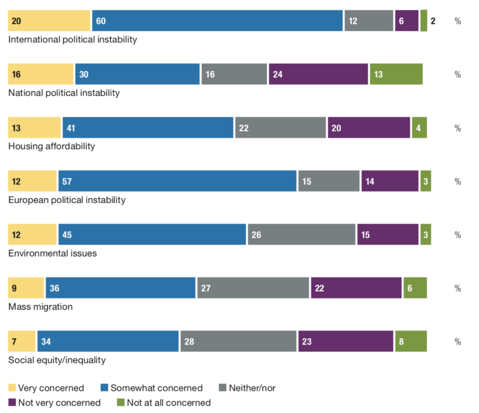

The world changes really fast, and today we cannot guarantee 100% that this market is safer than the other. The risk is always present when it comes to geopolitics. The biggest concern of real estate agents during 2019, according to PWC report is the international political instability. We have the Brexit situation, Turkey, USA and others that can quickly turn the way we are building our sales strategy.

Social concerns impacting real estate in 2019 Source: PWC Global Trends 2019

Social concerns impacting real estate in 2019 Source: PWC Global Trends 2019

Brexit impacts

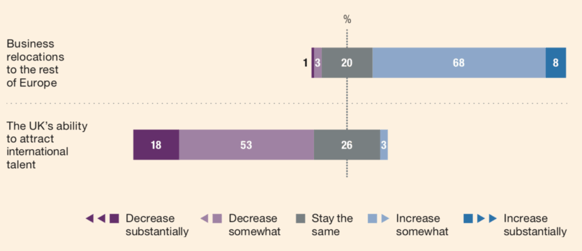

When we think about political instability, it is not hard to think about Brexit as the due date of 29 March 2019 draws closer without any clear vision of what will happen. Theresa May is still trying to negotiate the best deal for the UK, but her peers are not happy at all with what's she's bringing on the table. Many things can, and will, change until the due date.

The interesting thing here is that Brexit is something that is more inside European investors than global investors coming from places like Asia or the Americas, for example. 83% of real estate professionals believe that there will be a difference in economic growth between the UK and the EU during 2019. In fact, more than 70% believe UK's capacity to attract international investors will decrease after the Brexit date.

Impact of Brexit on real estate investment in 2019 Source: PWC Global Trends Report 2019

Impact of Brexit on real estate investment in 2019 Source: PWC Global Trends Report 2019

Affordability

Even though there is also social inequity, with the lack of social housing and senior care, this won't be the main concern during 2019. Instead, the main focus will be on affordability as the prices are going up.

According to PWC Global Trends Report, almost 50% of the interviewees believe prime assets are over-priced. This issue is especially relevant in markets like Spain and Portugal where the average wages are lower. However these markets remain pretty interesting for foreign investors as the prices per m2 are still lower when compared to it's European peers.

In Europe, prices will continue to go up as construction costs and interest rates are also expected to increase in the next 3 to 5 years.

European business environment in the next 3–5 years Source: PWC Global Trends 2019

European business environment in the next 3–5 years Source: PWC Global Trends 2019

The residential sector is the real estate professionals favourite as it is the one that brings a more resilient outcome. However, office spaces are also on the spotlight in 2019.

Technology will be king during 2019

This year you will be hearing a lot people talking about technology. This is a sector that is working hand in hand with real estate, to bring the best solutions to professionals.

The number of startups dedicated to real estate tech will continue to increase and invest on development, especially because the market is becoming more and more competitive. But we should also note that financial tech has a great impact on the sector, as it helps to reduce transaction costs by providing more automated operations.

Artificial intelligence is here to stay

There has been a growing hype about the introduction of AI in the real estate sector. But how will this be introduced? AI can be a powerful partner when it comes to improve building efficiency and safety.

Companies like WeWork, and smart buildings like The Edge (see the video below), are already putting their cards on the table when it comes to analysing user behaviour in their shared office space to redesign the spaces, and to improve their services offer.

[embed]https://www.youtube.com/watch?v=rT81J1FjI_U[/embed]

Consumer behaviour will impact real estate

For sure you already had the feeling of "God, I forgot to buy Carrie's present and her birthday is in 3 days", and then you though "I am buying something quickly online". The customers expectations when buying, and towards the deliver date, pushed logistics business to take a giant leap that might face a few challenges.

We’re going to see investments in network communications in the same way we may have looked at hard infrastructure investment in the past. PWC Report 2019.

There is a need for governments to invest on their transportation structure (roads, airports, trains, etc), to cope with this growth and, even though we know that the world wasn't build in a day, this is something you want to keep an eye on. The development of the transportation network will impact land values and investment opportunities, so don't miss out your chance.

New real estate actors arrive on the landscape

During 2018 we were present at the RENT PropTech fair in Paris. We gathered with real estate professionals to know who are the new actors coming into the real estate market. Here we present you the 5 new actors that will and are arriving in the sector.

- « New Gen Sous Steroids »: that use the best technologies available to improve it's services.

- « iByers » agencies like Opendoor

- « Low Cost » real estate agencies that heavily use marketing and communication to boost their sales.

- « Automated managers », that simplify and automate everything related to real estate business chain.

- « Online hunters » like Leosquare in France.

If you want to learn more about them, please learn our article fully dedicated to them.

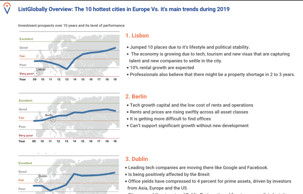

What will be the hottest cities in Europe?

According to PWC Global Trends, the hottest cities in Europe during 2019 are the following.

It is then, with no surprise, that we reach to the conclusion that during 2019 we will have a mixture of newcomer cities, like Portugal, and mature markets, like Germany, that is still capable of being at out top 10 cities in Europe when it comes to real estate, even though the prices are really high.

If you want to have access to an overview per country download our overview on the top cities and their main trends.

Prepare yourself in advance with ListGlobally

To stay in the forefront of real estate, you must work with a foreign audience. You need to take the best tools available on the market to optimise time (for you and your customers).

ListGlobally is the world's largest network of property portals (+100 portals in +60 countries). One click, and your property is promoted all over the globe reaching an international audience. We offer real estate agents international exposure, and we translate their listings details into 25 languages.